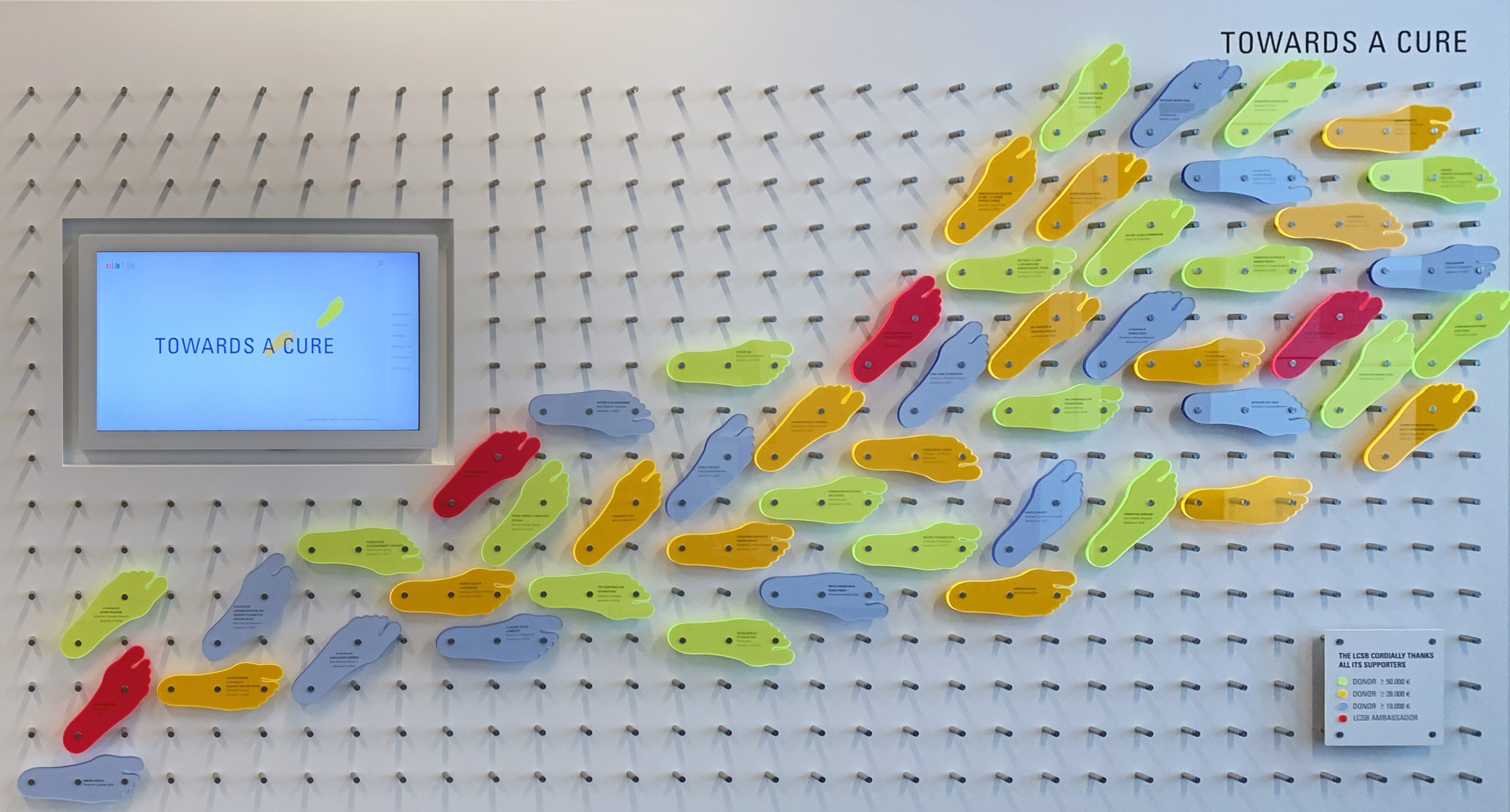

Support the LCSB

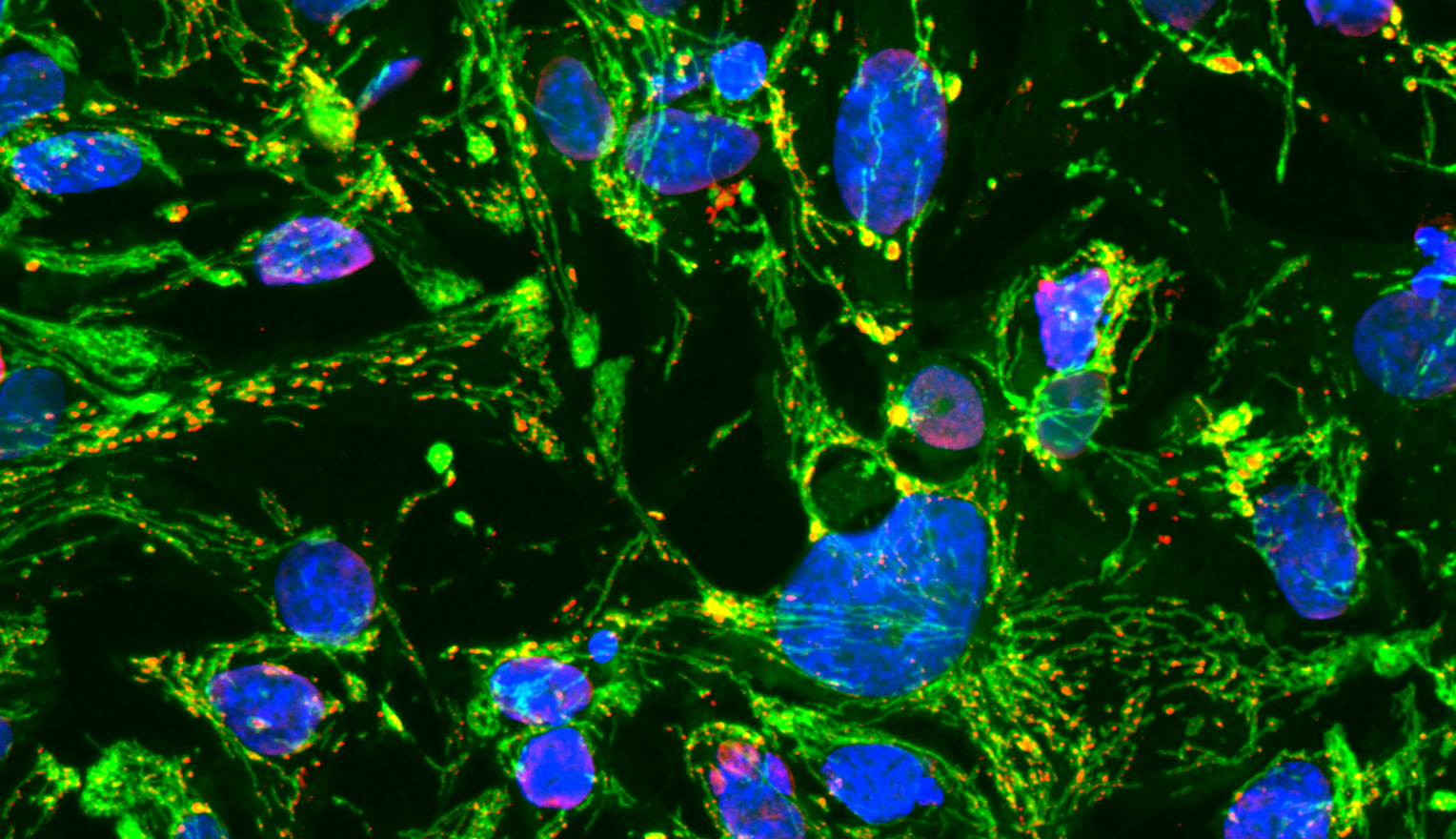

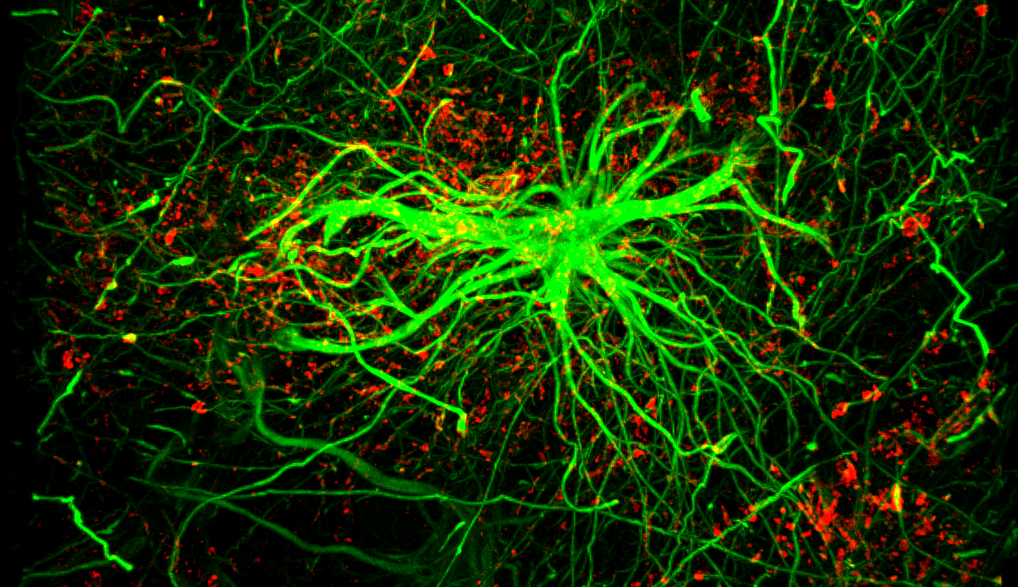

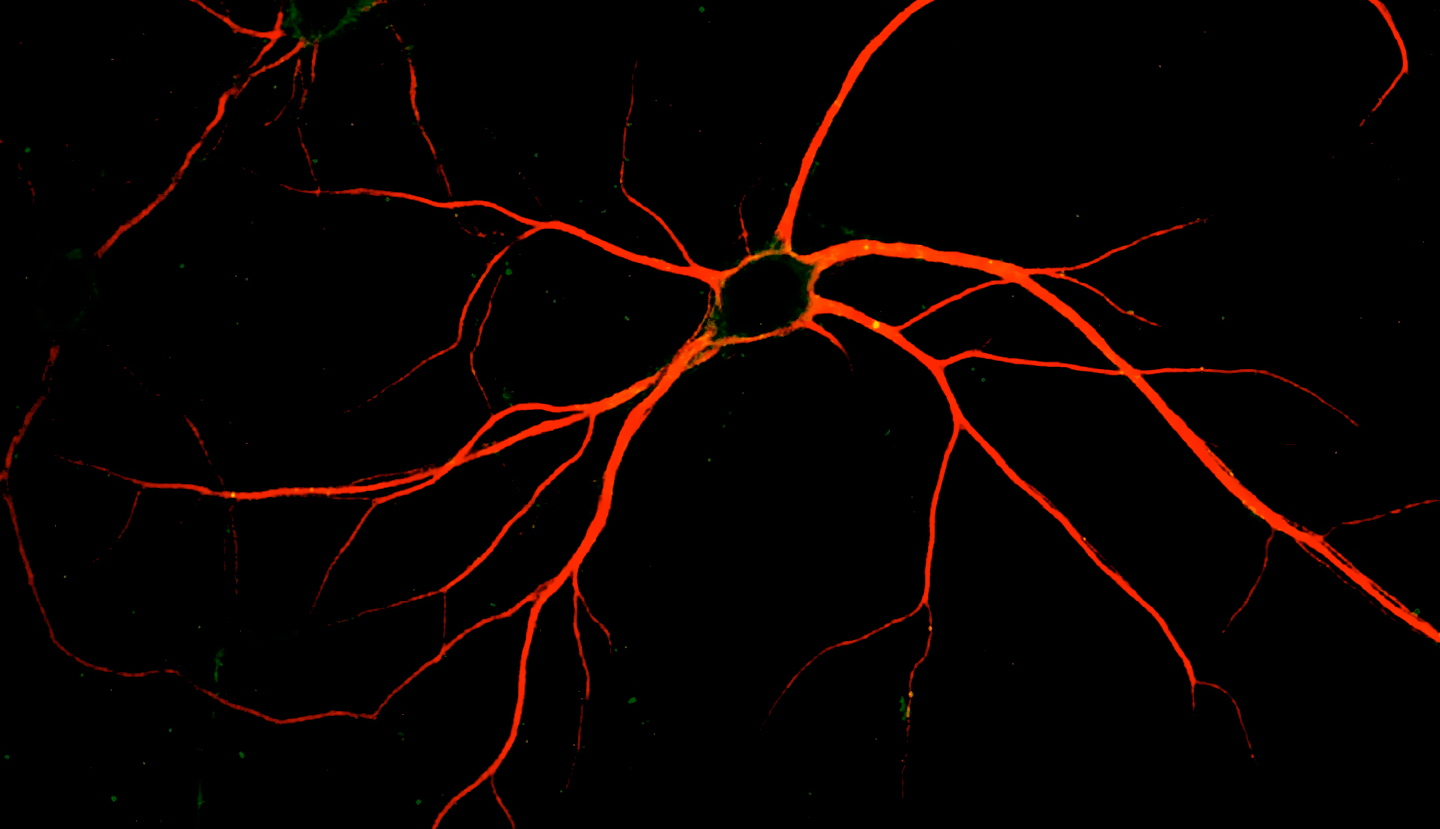

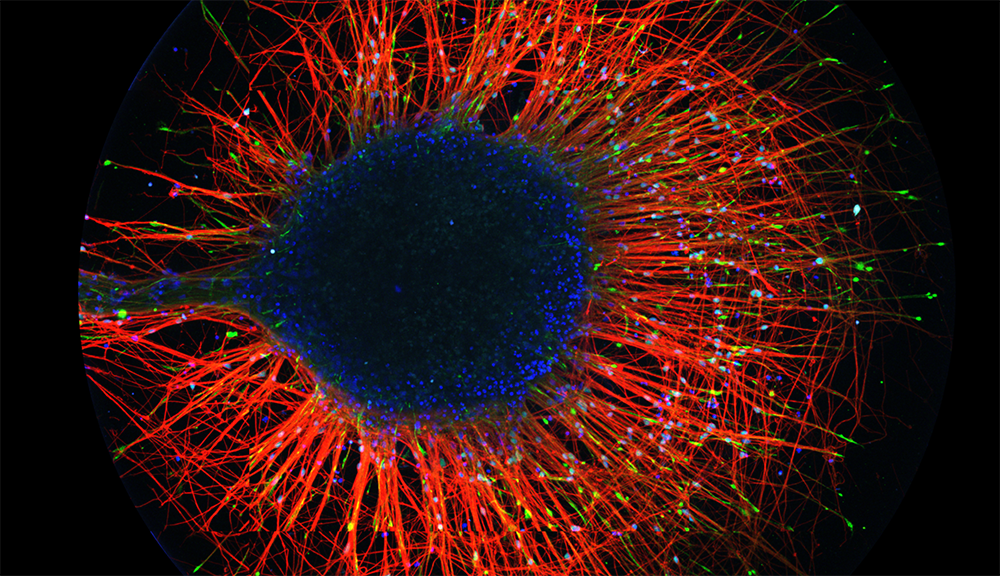

Thanks to your crucial support, our researchers can pursue innovative pilot projects and ambitious endeavors, bridging the funding gap and pushing the boundaries in various fields, including neurodegenerative disease.

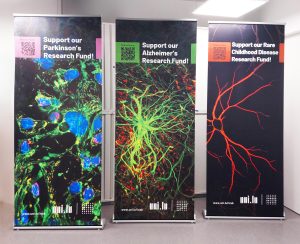

The LCSB Funds

In 2024..

27

donors supported the LCSB

31

projects were funded

2,174,515€

was donated

Fundraising Highlights

-

Towards earlier diagnosis and treatment: LCSB brain research receives generous foundation support

-

-

How to make a donation?

Any amount below €10,000 can be donated directly to the University. We would advise making any donations above €10,000 to the Luxembourg University Foundation.

Donations less than €10,000

University of Luxembourg

IBAN: LU19 0019 2955 5270 5000

BIC: BCEELULL

Donations more than €10,000

University of Luxembourg Foundation

IBAN: LU34 0019 4055 4574 9000

BIC: BCEELULL

Do you wish to make a donation in honour of someone or to mark a special occasion?

- To celebrate a birthday, wedding, holiday, or another special occasion?

- To make a donation to the LCSB in memory of someone

please use the information below to make a donation to the LCSB via bank wire transfer:

Name: University of Luxembourg

Bank: BCEE

IBAN: LU19 0019 2955 5270 5000

Mention: project name / in honour of…

The University of Luxembourg is allowed to receive gifts that are tax deductible in Luxembourg on the part of donors, within certain limits set by articles 109, 112 and 168 of the Luxembourg Income Tax Act.

It is specified that in-kind donations to our University are not tax-deductible for Luxembourg tax purposes.

A tax receipt is issued by the University of Luxembourg for every gift.

NB: For potential tax deductibility in other States, please refer to a foreign tax expert.

The University of Luxembourg is able to accept a wide range of assets, from movable assets (accounts, securities, etc.) to real estate.

With your legacy to the University of Luxembourg, you are shaping the future of science and education.

You will create new knowledge, support talented students and enable ground-breaking research in a field that is close to your heart. Your commitment has an impact across generations – it opens doors for young talent, strengthens scientific innovation and helps to answer pressing societal questions. Your legacy also helps to secure essential professorships in the long term, thereby ensuring the continuity and quality of academic teaching.

A legacy is much more than a donation: It is a lasting investment in excellence, progress and the future of Luxembourg.

Legal information:

Information you need for your will:

- The University of Luxembourg must be named as a beneficiary in your will

- Official address of the University:

2 place de l’Université

L-4365 Esch/Alzette

Tax regulations:

A bequest in favour of the University of Luxembourg is generally exempt from inheritance tax, provided that the deceased was resident in Luxembourg and his or her estate consists exclusively of assets located in Luxembourg. The University of Luxembourg itself is exempt from these taxes in accordance with Article 58 of the Law of 27 June 2018 on the organisation of the University of Luxembourg.

Philanthropic Advising:

There are many ways to support the University’s mission. You can include an area of research of your choice in your will or leave us an unrestricted bequest. In the latter case, we can use your bequest conscientiously and flexibly to support research in the areas described here as well as the needs of our students.

We would be happy to discuss with you what you would like to achieve with your possible donation. You can contact us at any time. We recommend that you consult a notary before drafting or updating your will.

In September 2013 the Luxembourg University Foundation was launched. The Foundation’s objectives are to support the academic and scientific activities, as well as initiatives of general interest of the University.

The Luxembourg University Foundation has been granted an initial capital of one million euros and has been placed in the professional care of the Fondation de Luxembourg, which will provide financial and operational management, as well as supervision.

It is also hoped that the Foundation will assist the University in attracting additional international funding.

Our Fundraising charter (in French, PDF) provides additional information regarding patronage activities and corporate philanthropy.

Testimonials

‟

Philanthropy, to me, shares a kinship with entrepreneurship: the rewards, when successful, yield a deep-seated satisfaction that money simply cannot procure. Over the past two years, I’ve had the privilege of backing a diverse range of University initiatives through my family foundation. This includes lending my support to the pioneering Parkinson’s research led by Paul Wilmes and actively sponsoring the UL Incubator.

Fostering young entrepreneurship has always been a passion close to my heart, and I take immense joy in contributing to the University’s noble mission of molding the next wave of enterprising talents. It is a pleasure to play a part in shaping the future of innovation and enterprise.

Entrepreneur and one of the earliest donors of the LCSB

News

-

Towards earlier diagnosis and treatment: LCSB brain research receives generous foundation support

ResearchLife Sciences & MedicineLearn more -

-

Supporting research through targeted fundraising

Outreach, ResearchLife Sciences & MedicineLearn more

Thank you for your interest in supporting our research at the LCSB!

If you have any questions about how to make the biggest impact with your donation, please contact us: