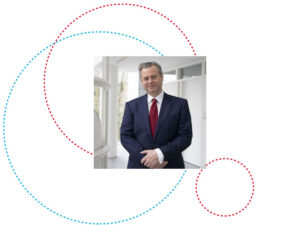

On 6 February 2023, Dirk. A. Zetzsche, Professor of Law at the University of Luxembourg, participated in the 61st session of the Commission for Social Development at the United Nations Headquarters in New York City, USA.

Prof. Zetzsche, who is also the Chairholder of the ADA Chair in Financial Law (Inclusive Finance), presented the topic “Financial Inclusion as Remedy against Inequality in Labour, Employment and Participation”.

Exposure of the vulnerable to risk

During his speech he mentioned several reasons why inequalities as well as environmental, social health and political crisis hit the vulnerable first: “The incomes tend to be under-diversified and the livelihood rests on what they earn with the hands. Vulnerable people have usually lower education, and changing regions and professions is difficult. Vulnerable and marginalised groups of society have usually less influence on the overall economic, social and governance conditions. Finally, they tend to be risks taken, not risk makers. Considering that, to protect them, regulation is of most importance. If regulatory, capital and resources are limited, the question is, what regulation works best? Where shall we focus?”, claims Prof. Zetzsche.

Impact of Covid-19

According to Prof. Zetzsche Covid-19 first highlighted the exposure of the vulnerable. Hunger, which we had hoped to diminish returned to hundred millions of people every day. Additionally, the pandemic undermined years of efforts furthering sustainable development and forced all of us to digitise.

Financial inclusion as precondition for sustainable development

“In some countries, adequate labour markets regulation is lacking, but in most countries these regulations exist, but only on paper. Due to informality and underlying financial relations, government to people payments could often neither be calculated nor paid off. Employee related measures in public benefits could not soften the impact of the pandemic, even when funds were made available by the Fiscus”, said Prof. Zetzsche.

Furthermore, he explained that the core of the problem was financial exclusion: “Financial inclusion means economic and social empowerment for the disadvantaged. It deserves more attention, as it is a precondition for any crisis resilience policy, agenda, race, social or economically based. United Nations have recognised the importance of financial inclusion for several years now and in the Secretary General’s report, we find two references to it. One time as access to credit and one time as access to digital payments”.

Digitisation as key to financial inclusion

Professor Zetzsche sees digitisation as a key enabler to financial inclusion that bridges the last mile issue in remote locations, trains and protects the vulnerable, and traces and further financial flow in both directions. He is convinced that by focusing on digital financial inclusion, institutions will be best equipped in many countries. Central banks, finance ministries and financial regulators become part of the solution and financial supervision becomes instrumental in furthering equality in the labour and social sector as well as the economy at large.

Inclusive Green Finance Framework

In terms of Inclusive Green Finance (IGF), Prof. Zetzsche thinks that an official IGF policy is necessary for two reasons:

- Markets are poor at assessing uncertain long-term risk due to the lack of reliable data regarding the future.

- Inclusion and the environment are public goods and individual entities do not directly rehab the full benefits from investment in financial inclusion and environmental protection.

“In the absence of regulation, private actors will underinvest in inclusion and environmental protection, and this is regardless of whether we speak about social, labour or financial inclusion”, explained he.

Professor Zetzsche concluded his speech with the following statement: “Financial inclusion offers a choice for those with few opportunities and is a, if not the most important cornerstone for steps that seek to fill the 230 Agenda for Sustainable Development with life. Any effort aiming at furthering employment growth and difficult opportunities should seek to further financial inclusion as part of a comprehensive strategy”.

Click here to listen his full speech. (at 34:00:00)

About the Commission for Social Development

The Commission for Social Development (CSocD) is one of the eight functional commissions established by the United Nations Economic and Social Council (ECOSOC) and consists of 46 members elected by the ECOSOC. It is the advisory body responsible for the social development pillar of global development.