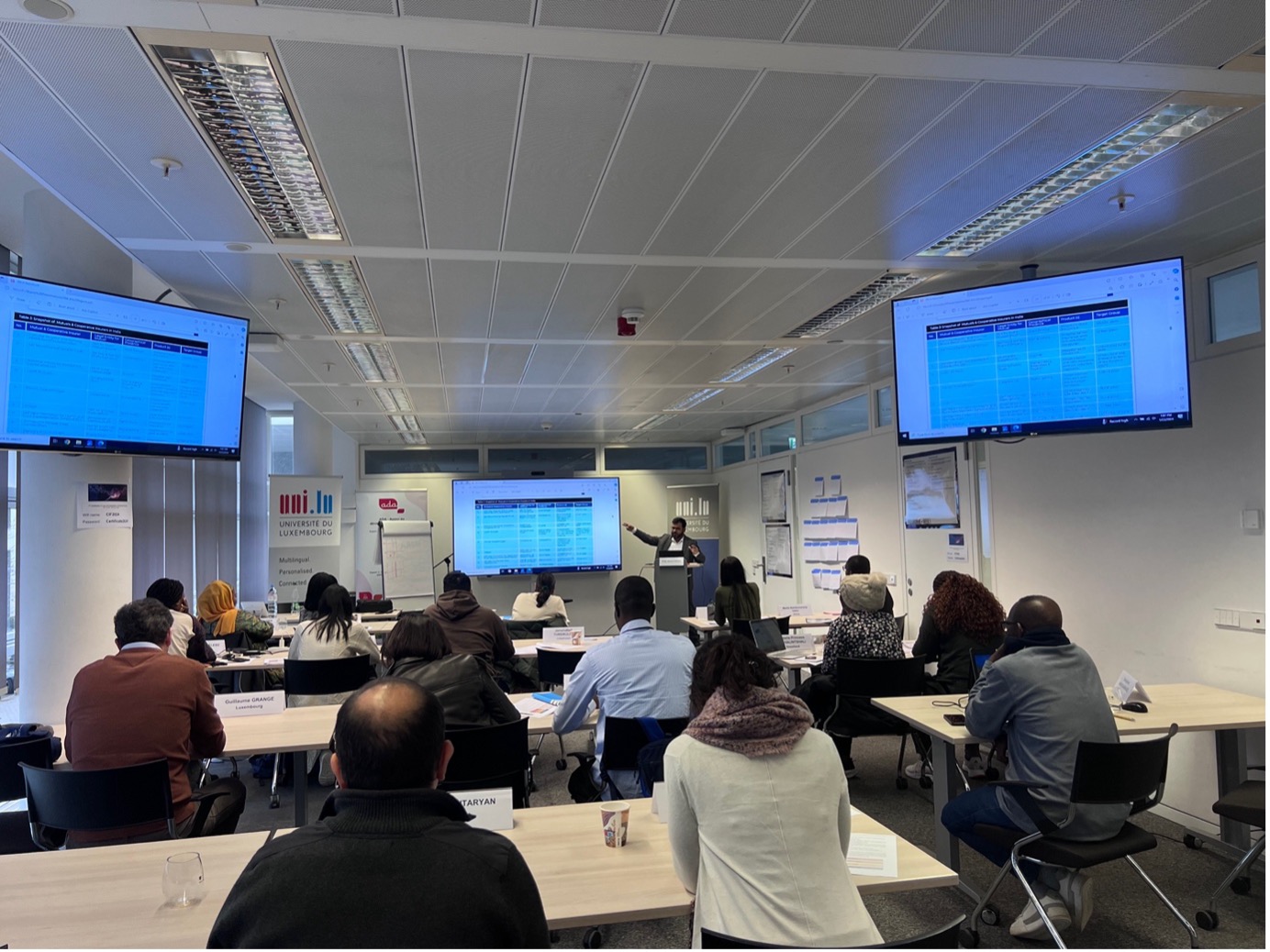

On 16 January 2024, our 8th edition of the Certificate in Law and Regulation of Inclusive Finance started in Luxembourg. During a period of two weeks, a total of 19 participants from 12 different countries across Africa, Asia, Europe and Latin America attended enriching lectures and worked on case studies at the University of Luxembourg in collaboration with its certificate partners Appui au Developpement Autonome (ADA), European Investment Bank (EIB) and Arendt. We sat down with some of the participants to gain some insight into their experience.

After the first week of the 2024 edition of the Certificate, Suresh Vesam (India), Carolina Bianchini (Italy), Sophy Ly (Cambodia) and Aram Mkhitaryan (Armenia) took some time to share what they learned in Luxembourg and how they can put their knowledge into action in future careers.

How did you learn about the programme? And why were you interested in applying for it?

“I came to know about this course through one of the previous participants from India and he gave very strong provoking words about it and the faculty and its organising mechanisms. The Law and regulation of Inclusive finance is a unique subject for the practitioners at the grassroots level like me because it is a wider scope for the empowerment of the marginalised communities in the rural villages, I had attended many program on micro finance and rural agriculture finance and this subject created much interest to learn and practice for the empowerment of the marginalise in the Law and regulation framework. That is the interest to apply for this course”, said the CEO of Nestham Foundation, Suresh.

In the same way as Suresh, based on word-of-mouth, the executive Director of Agroleasing Leasing Credit Company LLC Aram stated, “I first heard about the ADA inclusive finance certificate programme through a colleague who had previously completed the program and spoke highly of the experience. As someone who is passionate about financial inclusion and empowering underserved communities, I was eager to apply for the program to gain a deeper understanding of inclusive finance practices and strategies.”

On her side Carolina was very interested in inclusive finance applied for the development sector, also she wanted to support disadvantaged communities. She told us “I was looking for opportunities to know more about it and apply it to my work. One day, I was checking my LinkedIn feed and I saw a post about the Certification, which immediately caught my attention, so I decided to apply.”

For Sophy, it was recommended by her CEO, she stated “The course curriculum is comprehensive and covers the latest topics in inclusive finance. The certificate is issued by the University of Luxembourg, which has a formidable reputation in both academia and the industry. Luxembourg is also a financial hub, home to the European Investment Bank, the world’s largest multilateral financial institution.”

What is inclusive finance, what does it mean to you?

“Inclusive finance includes individuals and micro entrepreneurs who have limited access to traditional financial institutions and services, often due to factors such as poverty, location, gender, or lack of collateral. Thus, the aim is to provide them affordable financial services and the opportunities for better living conditions” said Aram who we can see on the picture below.

For the CEO Suresh, “The Inclusive finance means to provide and access to the communities where they are unreachable to the mainstream financial aspects like savings, credits, loans, equity and insurance to build strong wealth to the families to improve living standards of the underprivileged communities.”

What aspects of the programme can you apply to your work?

Suresh is ready to brings the concept in his village based in India. He said, “Based on the concepts and successful case studies of the other practitioners, we shall apply to bring our stockholders into inclusive financial aspects in a legal framework and create strong base for providing transparent practices in savings , loans, insurance, control and monitoring mechanisms, Risk Management for the financial and non-financial aspects. I would apply this concept in one of the village in Tamilnadu, India, to provide and improve sustainable income through the Green impact Projects.”

On the other hand, Carolina who is currently working with UNDP in Cuba stated “Inclusive Finance is one of our strategic priorities in our project portfolio. All the programme gave me useful and interesting insights for my work, allowing me to deepen my knowledge in this topic. Personally, I particularly enjoyed the sessions about Microfinance and Impact Investing, among others.”

Aram who works in Microfinance saw the opportunity, “The program gives us opportunity to get familiar with different approaches of getting investments through developing banks located in Luxembourg. Furthermore, I believe that learning about universal standards for social and environmental performance will play a key role for our organisation future growth.”

Finally, Sophy said “The programme helped me grasp the general idea of financial inclusion; in particular, the EGS concept and measurement. After completing the Certificate in Law and Inclusive Finance, I gained the skills to create a more holistic financial inclusion roadmap with more suitable project measurement at CBC, which could contribute to a more positive impact in Cambodia. I also could understand how to measure the social and environmental impact of my project or initiative from the lecture.”

What did you think of Luxembourg?

“Luxembourg City is a dynamic and cosmopolitan place with a unique blend of history, culture, and modernity. It offers a mix of historical charm, natural beauty, and economic opportunities.”, commented Aram.

Suresh who never experienced weather like in Luxembourg, snowy or rainy was quiet amazed, “I am well impressed the city of Luxembourg for its well-behaved population and sound public amenities and delicious mouthwatering European Food items and especially it is a hub of financial institutions. I’ve experienced free public transport and nice living conditions, it is a safe and secured city. The city of friendship and finance.”

“I loved Luxembourg city, I appreciated its lovely people and amazing views, also thanks to the sightseeing organised by the University of Luxembourg with all of us participants to the Certification. I think it is a city full of opportunities to learn and grow professionally, especially in the sector of inclusive finance. The quality and efficiency of public transportation was remarkable as well!”, reasons Carolina.

“I miss Luxembourg and its beauty”, said Sophy. “I hope to return someday. A professor’s words that stuck with me are, “Consistency and progress are key to achieve financial inclusion for all.” I will be a Luxembourg ambassador and share why this country is the EU’s financial hub. I cherish the memories of my friends from diverse backgrounds, the lessons we learned in class, and the places we explored together.”

The interviews have been edited and condensed for clarity. If you want to learn more about the Certificate, please click here.