On 6 July 2023, the Chair and Research Programme in Sustainable Finance, funded by the Ministry of Finance and the Ministry of Environment, Climate, and Sustainable Development, organized the “2nd Conference in Sustainable Finance” at the University of Luxembourg.

International researchers from the world’s top Universities from the US (Columbia University, Stanford University, University of Maryland), Canada (University of British Columbia) and Europe (Oxford University, Cambridge University, Copenhagen Business School and others) came to Luxembourg to discuss sustainable finance topics.

The conference covered some of the most critical topics in Sustainable Finance, such as:

- Firm-level management of ESG-related challenges.

- Expected rates of returns and risks of ESG investing.

- The power of divestments (i.e., investment strategies that exclude certain industries or firms from portfolios) to impact the affected firms.

- The impact of ESG disclosure on mutual funds.

In addition, the discussion frequently evolved around the central question of regulation in the area of Sustainable Finance addressing questions such as whether recent regulatory initiatives, mostly within the EU, are going too far or not far enough in order to accelerate the transition to greener, more sustainable financial markets.

While the first part of the conference was academically oriented, the last session of the conference was open to the public and had the goal to share knowledge with the financial industry. That special session at took place at the Banque de Luxembourg and included keynote presentations from Prof. Caroline Flammer, Professor of International and Public Affairs and of Climate at Columbia University and Chair of the Academic Advisory Committee of the United Nations-supported Principles for Responsible Investment (PRI), and Prof. Jonathan Berk, the A.P. Giannini Professor of Finance at the Graduate School of Business, Stanford University, and concluded with a panel discussion on “Designing Green Financial Markets of the Future”. The panel brought together the academic keynote speakers with Mr Jean-Marc di Cato, Chief Risk Officer of Clearstream Holding.

Prof. Flammer’s keynote presentation provided a very comprehensive overview on topics in Sustainable Finance drawing on the impressive body of research that Prof. Flammer has produced in the area of Sustainable Finance. She emphasized that:

- All three components of ESG are closely linked to each other and, most importantly, that the Environmental and Social dimensions are integral parts of the Governance dimension.

- Planning horizons are vitally important and Sustainable Finance is inherently linked to a long-term planning horizon.

- Green bonds represent a promising financial product through which investors can have a real impact on issuing firms. However, without external certification, green bonds might also be subject to greenwashing concerns.

- Public pension and sovereign funds might play a special role in the transition to greener financial markets through (a) active engagement with their portfolio companies, (b) investments in externally certified ESG-related financial products such as certified green or social bonds, and (c) active engagement with public policy.

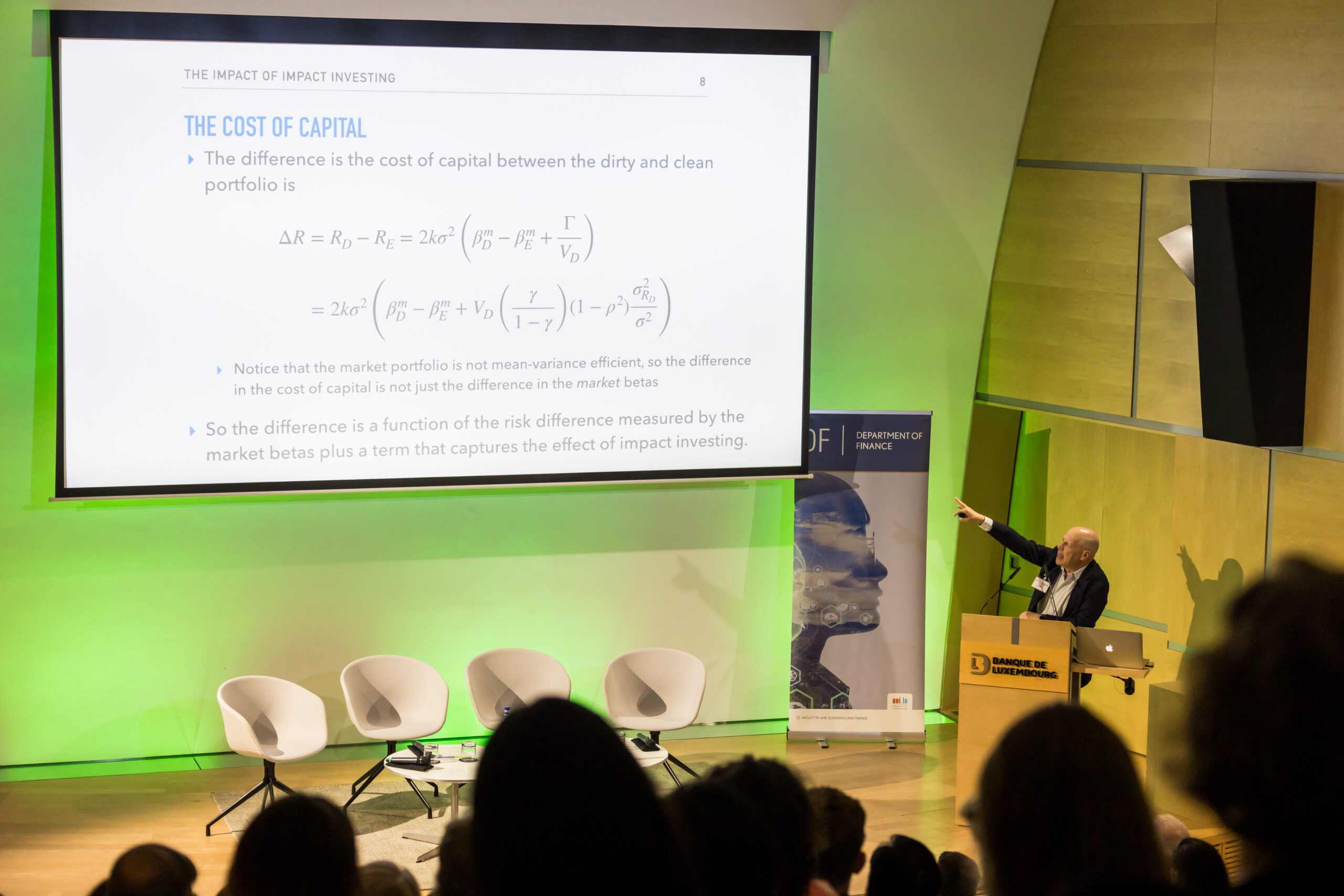

Prof. Jonathan Berk’s keynote presentation concentrated on a specific research project, titled “The impact of impact investing”, in which Prof. Berk and his co-author Prof. van Binsbergen study the impact of divestment strategies on the excluded companies. As of now, divestment strategies (i.e., the application of exclusionary filters that exclude certain industries or firms from portfolios) represent the workhorse of the industry to implement responsible investment strategies. To what extent, however, such exclusions have any impact on the excluded, brown firms in the sense of increasing the funding costs of these firms and providing incentives to transition to becoming green is not clear and is intensely debated in the academic literature. Prof. Berk explained very energetically that in the framework considered in the paper divestment strategies do not provide strong incentives for brown firms that are excluded from portfolios of sustainable investors to transition and become green. This result puts into question whether ESG-funds that focus on exclusions will have any impact on the real economy.

The panel discussion following the keynote presentations revisited some of the topics brought up in the keynotes with a special focus on a forward-looking perspective. While some topics were intensely debated, panelists agreed that financial markets will have to become greener over the upcoming years to contribute and fund the transition towards more sustainable economies. Important steps along the way will most likely include improved regulation to prevent greenwashing and more active engagement by investors, among other things. Panelists, however, also agreed that financial markets will not be able to do it alone and that governments, regulators and, broadly speaking, public players will have to become more active and take on more responsibilities.

We thank all the participants and the panelists for their participation and for the fruitful discussion on this vital subject.