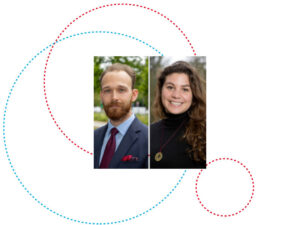

Prof. Werner Haslehner, Professor of Tax Law and holder of the ATOZ Chair in International and European Tax Law at the Faculty of Law, Economics and Finance, along with fellow University of Luxembourg Tax Law Associate Professor, Katerina Pantazatou and co-editors Barrister Timothy Lyons KC (9 Essex Chambers, London, UK), Georg Kofler, Professor of Tax Law (Institute for Austrian and International Tax Law) and Alexander Rust, Professor of Tax Law (Vienna University of Economics and Business) has published “Alternative Dispute Resolution and Tax Disputes” from the Elgar Tax Law and Practice series.

Beyond a comprehensive analysis of the legal tax treaty framework as applied to MAP (Mutual Agreement Procedures) and arbitration, the volume also offers an in-depth discussion of primary and secondary EU law rules on tax dispute resolution, including implications of EU general principles, fundamental rights and internal market rules with original insights from dispute resolution mechanisms found in non-tax areas such as trade and investment law.

The volume, which features contributions from Robert Danon, Sjoerd Douma, Javier García Olmedo, Arno Gildemeister, Daniel Gutmann, Werner Haslehner, Alexia Kardachaki, Georg Kofler, Timothy Lyons, Peter Nias, Katerina Pantazatou, Katerina Perrou, Alexander Rust, Paloma Schwarz and and Laura Turcan is the result of a two-year long research project originating within the ATOZ Chair in International and European Tax Law.

More information about “Alternative Dispute Resolution and Tax disputes” can be found on the publisher’s website.