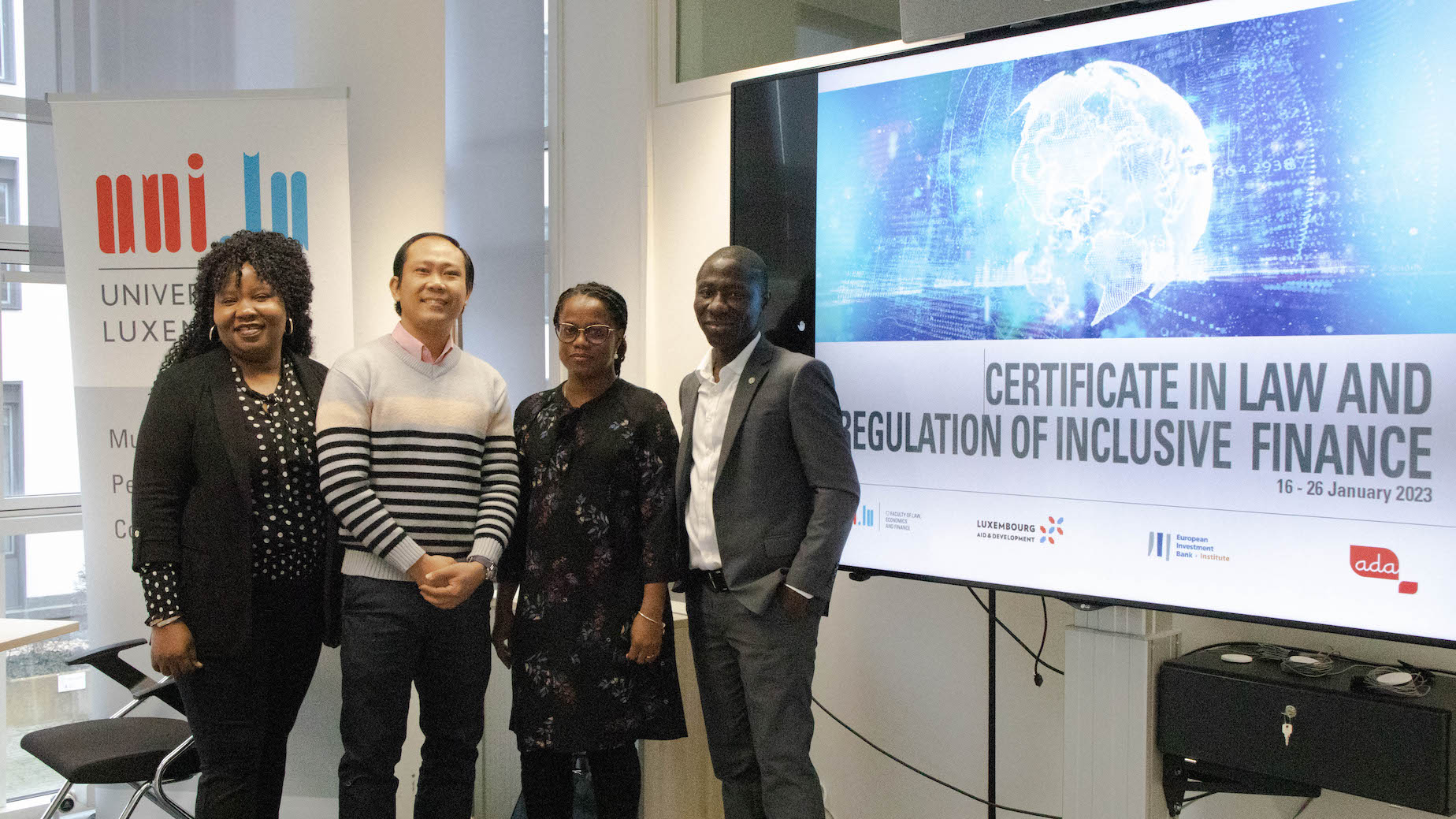

On 16 January 2023, our 7th edition of the Certificate in Law and Regulation of Inclusive Finance started in Luxembourg. During a period of two weeks, a total of 17 participants from 13 different countries across Africa, Asia, Europe and Latin America attended enriching lectures and worked on case studies at the University of Luxembourg in collaboration with its certificate partners Appui au Developpement Autonome (ADA), European Investment Bank (EIB) and Arendt. We sat down with some of the participants to gain some insight into their experience.

After the first week of the 2023 edition of the Certificate, Fanny Fanou Ako (Benin), Bunrith Ly (Cambodia), Benjamin Nii Offei Dodoo (Ghana) and Eunice Tavares (Cape Verde), took some time to share what they learned in Luxembourg and how they can put their knowledge into action in future careers.

How did you learn about the programme? Why did you decide to participate?

“I heard about the certificate through ADA Micofinance and it soon awakened my interest as the programme stands out for its expertise in law and regulation for financial inclusion. There are not many trainings available for this little-known topic, and role of the regulator in financial inclusion is often not very well understood”, said Eunice Tavares, who works in microfinance at the Central Bank of Cape Verde.

Benjamin Nii Offei Dodoo, a Senior Retail Operations Officer at Ecobank Ghana PLC heard about the certificate online. “I wanted to pursue further education in my chosen field and came across a few courses,” Benjamin says. “I decided to choose an in-person programme that covers various subjects relevant to today’s financial sector. I wanted to come to Luxembourg, because it’s the European financial hub and I wanted to learn from the best in the industry.”

What is inclusive finance? What does it mean to you?

For Fanny Fanou Ako, Director of Women Empowered NGO in Benin, “Inclusive Finance means the provision of tailored financial services (microcredit, savings, digital financial services etc…) to meet the needs of people initially excluded from regular financial systems such as women, low-income people, small farmers, small business owners etc.”

Eunice has yet another way of looking at it. “Financial Inclusion has a very important role in the fight against poverty and improvement of the living conditions of the low-income population, it is an update of Microfinance in a broader sense, because it includes many institutions and services providers of which the main objective is to make financial services affordable, fair and sustainable and also help the services providers to achieve their financial and social performance.”

What aspects of the programme can you apply to your work?

For Benjamin, the programme has helped him to understand the system as a whole, leading to better meeting customer needs. “As a banker within the retail operation unit of a commercial bank, I already had an in-depth understanding of why and how each player in the financial ecosystem acts but could deepen this knowledge during the Certificate. I’m now able to better drive the financial inclusion agenda by giving relevant data gathered to the banks management team. I believe that this will enable us to design sustainable products and services that is tailored towards our customers’ needs, bearing in mind financial inclusion and green finance”.

“Several aspects of the programme can be applied to my work, especially social performance, green finance, and Fintech as in my country there is a need to revise strategies and policies in order to adapt to new current demands, mainly from partners and accelerate the digitisation process”, commented Eunice.

What do you think of Luxembourg?

“I’m really impressed”, said Bunrith. “On our first day we did a 2-hours city tour, which was great. We quickly learned how to use the free public transportation here to reach the city centre, restaurants etc. This helped me a lot during my 2-week stay here. After the tour, I could easily travel by myself”, he continued.

Although all participants interviewed appreciated the free public transportation and felt very welcomed here in Luxembourg, Benjamin was particularly inspired, “I think I could write a book about the Grand Duchy of Luxembourg, when given the chance. I read quite a lot prior to my trip and I must confess I was blown away. You can’t help but fall in love with the country. The beautiful scenery and picturesque streets were worth capturing images. The people are very open and welcoming, and this speaks volumes to me. This is diversity and inclusion. I got the notion why it’s multicultural. I also observed that Luxembourg has a lot of skilled multilingual global workforce and a business-friendly climate, coupled with an economic and political stability. Now, I totally understand why it is the financial hub within the European Union. A perfect cocktail for attracting wealth.”

“I noticed this catchy phrase ‘Let’s make it happen’ inscribed on different surfaces and it gave me food for thought. I kept conjecturing that this could be the reason why there is orderliness and systems work here. Because this is a clarion call to action thus all hands-on deck. This is the beauty of collective efforts, I thought. There is a lot to learn from Luxembourg. Saying goodbye to a lovely country like Luxembourg was sad. I wish I had more time to explore. I then told myself before departure “Ben will be back”. It almost escaped me to comment about the weather. It was cold !!! It was winter though,” reasons Benjamin.

Returning home with new acquired knowledge

The participants expressed their gratitude for the opportunity to participate in the Certificate and would like to thank the University of Luxembourg and its partners ADA, EIB and Arendt for the organisation, the special guests and the lessons learned. With a closing word, they return home with a wealth of newly acquired knowledge.

“I appreciate the opportunity to be a part of this great course. It’s a very important step in my professional life and made me think about a specialised study in the field. Thank you so much for allowing practitioners from around the world together for this wonderful learning experience”, said Fanny.

“Thank you for this great opportunity. As the microfinance sector evolves, please continue offering this certificate programme. It is even better to have alumni to gather the participants for the updates around the globe about the sector”, added Bunrith.

The interviews have been edited and condensed for clarity.