Recommitments are essential for limited partner investors to maintain a target exposure to private equity. However, recommitting to new funds is irrevocable and expose investors to cashflow uncertainty and illiquidity. Maintaining a specific target allocation is therefore a tedious and critical task. Unfortunately, recommitment strategies are still manually designed and few works in the literature have endeavored to develop a recommitment system balancing opportunity cost and risk of default. Due to its strong similarities to a control system, computer scientists from the University of Luxembourg propose to “learn how to recommit” with reinforcement learning.

Private equity is an alternative asset class which refers to direct investments in non-listed companies made at different stages of their development to create added value. These companies are then sold few years later with the expectation to obtain a significant capital gain. Early investments in strong performing companies help them to develop their business and make them more profitable. Contrary to the public equity market, private equity investments are not easily accessed as stocks and bonds.

Recently, private equity has been included in the portfolios of institutional investors such as pension funds, sovereign wealth funds, etc. These institutional investors have been building sizable allocation by investing indirectly’ to private companies through private equity funds. Indeed, managing such a less traditional asset class requires a high level of expertise to properly enter and exit direct investments. This explains their preferred modus operandi to invest indirectly as so-called limited partners through limited partnership funds in which they commit a certain amount of capital for a given period.

These commitments are irrevocable, and the related capital is progressively called over several years depending on the fund’s management strategy. Unfortunately, capital calls cannot be known in advance leading to unallocated capital waiting to be called. To make matters worse, the committed capital is not entirely called before the fund starts distributing from divestments. These distributions occur when the fund is only few years old and can only be reinvested by committing to new private equity funds. Generally, all the committed capital is not entirely drawn down which impacts investors’ exposure.

Few investigations have been engaged to evaluate the cost of maintaining uncalled capital. This is the reason why the current existing models remain rudimentary and depend on spreadsheet-based and trial-and-error approaches. These strategies are often error-prone and try to forecast future capital calls although the opportunity cost, i.e., the cost of being underinvested, and the risk of default in case of overinvestment can be very damaging for investors.

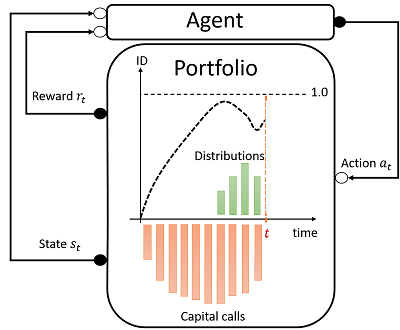

« In our work, we proposed to investigate an approach relying on reinforcement learning to learn how to size and time dynamic recommitments by modelling the decision process as a Reinforcement Learning problem (see Figure above) to discover reliable recommitment policies using a Proximal Policy Optimisation algorithm. Recommitment policies can be assimilated as control policies which should maintain a target allocation minimizing the opportunity cost while preserving investors from the risk of default. These control policies are trained using intensive HPC simulations based on synthetic cashflows allowing to go beyond classical situations, i.e., not restricted to existing market conditions. In summary, training recommitment policies allows limited partners investors to prepare to given scenarios while maintaining a target investment degree », explains Emmanuel Kieffer, research scientist within the Department of Computer Science at the University of Luxembourg.

Article « Proximal Policy Optimisation for a Private Equity Recommitment System« , November 2021